After working with global teams, living in Europe, and constantly traveling to and reading about other world economies in the pursuit to become a truly global citizen, I quickly realized the significant impacts of US policies on other nations, especially our economic policies and the dominance of our dollar currency. The US dollar has been the world’s primary reserve currency since World War II. Since the US supplied much of the Allied forces who paid in gold, the US became the owner of much of the world’s gold, and since this made returning to the gold standard impossible for countries who had depleted gold reserves, it was decided that world currencies would no longer be linked to gold but rather pegged to the US dollar since the dollar itself was essentially backed by gold.[1] To this day, the world’s reserves are still predominately US dollar reserves and at no point has the US dollar represented less than 50% of world currency reserves.[2]

Because of this, the capital markets of other countries are directly impacted by movements in the US dollar and the performance of the underlying US economy. In this post we’ll briefly discuss the reasons why emerging market (“EM”) currencies weaken against other developed-market currencies before discussing the negative implications for weaker EM currencies and whether digital currencies could eventually help solve the issues caused by volatile EM currencies and their dependency on US economic policies.

There are a variety of fundamental factors which influence the exchange rate and any periodic fluctuations of local currencies including the size of the economy, it’s importance in global trade, the openness of its financial markets, and its domestic economic policies. In essence, the overall perceived stability of the economy keeps the currency stable and trading in a tight range compared to a basket of other currencies. For example, during the 2008 financial crisis, the Swiss Franc saw massive inflows which greatly strengthened the currency due to the perceived strength of Switzerland as a global financial hub with sound economic policies.[3] On the contrary, smaller and less stable economies will see significant currency depreciation at the slightest sign of trouble as experienced with the Thai Baht during the Asian financial crises in the late 1990s which quickly resulted in widespread contagion throughout most other surrounding Asian countries. However, exchange rate stability for EMs can also be greatly influenced by factors outside of their control. For example, the Thailand government was equally fighting off speculative bets against their currency by George Soros during the Asian financial crises, and most emerging markets today are dealing with capital flight from investors after aggressive interest rate rises here in the US made the US dollar the best currency haven during rising inflation and a cooling global economy. So, while EMs can create a stable currency regime by focusing on internal fundamentals, there are certain external influences outside of their control which can significantly impact their currencies.

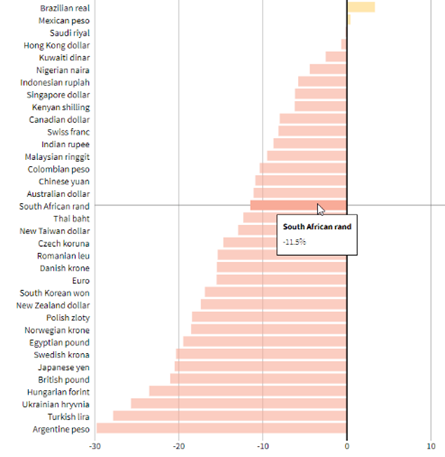

The negative implications for falling currencies in EMs are significant and ones that we (as average US citizens) rarely see or have to consider as part of our daily lives. First, imports for EM economies become more expensive because it now takes more local currency to buy the imported goods. This especially hurts the EMs who are importing key commodities such as oil, steel, etc. which are priced in USD and because these imports are so critical to their economy, it can result in a crippling expense which depletes any current account surplus they were previously enjoying. Secondly, because imports are more expensive, the country is at a high risk for inflation. As businesses’ costs rise for imports, they need to pass on these costs to consumers in the form of price increases for their products or services. The inflationary pressures decrease the purchasing power of individual paychecks and decrease the value of savings which disincentivizes sound personal finance practices. A third implication for weakening currency is the depletion of foreign exchange reserves. Due to the more expensive imports, the central government will deploy monetary policy to prop up the currency by using USD or other reserve currencies to buy the local currency and decreasing its supply on the open market. The more local currency that is purchased, the further depleted their reserves are which makes future monetary responses more difficult. As foreign reserves deplete, the country would be more likely to take a bailout from the IMF which could be subject to restrictive covenants. Fourth, since many EMs have debt denominated in foreign currencies, especially USD, weakening currency results in more expense debt that risks default. When EMs take out USD debt and its currency depreciates, more local currency is needed to pay back the debt. Similarly, companies within EMs could face a revenue and cost mismatch where most of their revenues are denominated in local currency but many of their expenses (especially commodities and potentially labor) are denominated in USD. These expenses are now more expensive in local currency terms which creates an insolvency risk from higher expenses but consistent revenues. Finally, if the weakening currency is largely due to interest rate increases in other markets, EMs risk capital flight and decreased foreign direct investment until interest rates within the country become more competitive. For example, as mentioned above, with the persistent increase in interest rates here in the US, capital is flowing into the US and out of EMs to take advantage of the safer and higher returns. The graph below shows the year-to-date percentage change of currencies against the dollar.[4]

The decisions by the US Fed and its monetary policies are effectively exported to countries around the globe for better or worse, and as long as the world continues to be on the dollar system this linkage will persist. Whether EM are consciously moving away from these economics or simply rethinking their reliance on the dollar for political reasons, we’ve seen countries start to question the US dollar’s dominance. For example, Saudi Arabia and China have discussed contracts to Saudi oil denominated in Chinese Yuan[5] and with the Ruble’s steep fall from Russia’s recent invasion of Ukraine, India is exploring ways to pay for Russian oil in Rubles and Rupees which is less expensive for Russia’s falling currency[6].

As countries look for ways to skirt the US dollar dominance, emerging tech of digital currencies has been pushed to the forefront. China has beaten all countries to mobilization of their Central Bank Digital Currency (CBDC), the e-CNY with the US and other countries currently researching and testing the launch of their own currencies. Through these digital currencies, payments will be made faster, with less friction/cost and on the surface will create benefits for many stakeholders. The potential privacy concerns are real, however, especially in an authoritarian regime like China to use the digital currency as a tracking mechanism on an immutable blockchain. The government would be able to identify who is purchasing what, how much, when, etc. which could naturally feed into actual surveillance system where all movements are seen and forever recorded. But will the digital currency actually help currency crises in the future?

In order to analyze, we have to make a distinction between a CBDC and an actual decentralized currency like Bitcoin. A common misconception of crypto is that it’s all decentralized. Digital protocols could be centralized, running through and controlled by institutions but making the functionality of finance more efficient through digitization, instant payments, low cost, etc. A CBDC is still centralized and controlled by the central bank. Effectively, if every country instituted their own CBDC, we are no different than where we are now with central banks controlling the supply of CBDC in the system and economics of the currency remain the same with monetary policy decisions affecting the value of the local currency compared to a basket of other CBDCs. Cross border payments still would involve exchanging of CBDCs determined by an FX rate based on the health of the countries’ economies and decisions of their central banks.

In a truly decentralized currency, the economics are controlled by immutable code with the supply of currency being determined by algorithms built into the code. Bitcoin for example, is an extensive network of “validators” or computers which solve complex math problems to confirm transactions on the blockchain and are rewarded with Bitcoin. The Bitcoin network has a cap of 21 million Bitcoin capable of being mined, and as more coins are mined, the harder it is to confirm transactions and mine future coins. The capped supply and incremental increases in the supply makes Bitcoin supply non-inflationary (although still price volatile as we’ve seen) and has resulted in flight to the currency in many markets where inflation is running rampant such as over 50% inflation in Argentina and 70% in Turkey. To protect the purchasing power of their money which loses value rapidly, folks in these countries have sought refuge in Bitcoin and other cryptos that are not tied to the health of their countries, policies of their local-country central banks, or exported policies of the US Fed.

Taking this one step further, “stablecoins” which are crypto currencies that are pegged to the US dollar could also offer further relief to individuals within EMs. Not all stablecoins are created equal and there has been recent troubles with algorithmic stable coins like UST (Terra) which (without getting too far into the weeds) are governed by underlying code to hold their value at $1. Once the system comes under pressure, there are no assets which back up the peg. However, stablecoins like USDT (Tether) or USDC (USD Coin) which are backed by reserves such as USD or other short-term securities currently have been identified to be more secure and stable, for lack of a better word. For example, someone in Argentina, could buy stablecoins with their Argentine pesos and that stable coin would hold its value which is a much better option than holding the hyper inflationary pesos.

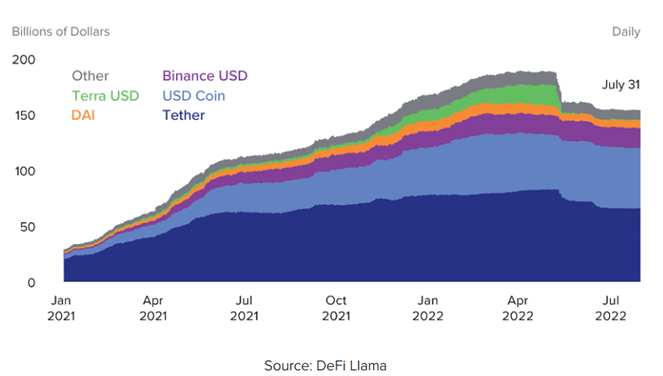

The graph to the left shows the exponential growth of the market capitalization of stablecoins which grew about 5x from Jan 2021. The dip we see in May 2022 was due to the Terra collapse.

Further, stablecoins offer a way for unbanked individuals to have greater access to the financial system and would also give citizens the opportunity to shield their savings from banks that may be more prone to fail in their home country. Additionally, since remittances are such a large portion of capital flows into emerging markets, stable coins offer a quicker and lower cost way for folks to send money back to families living in emerging markets. So, while stablecoins do not necessarily insulate EMs from monetary policy changes from the US Fed since the coins are essentially pegged to the US dollar, they do offer EM citizens the chance to take haven in a USD equivalent currency in order insulate their own savings from wild fluctuations in the value of their local currency.

While decentralized currencies are still at a very nascent stage and widespread use is far from mainstream, the emerging tech does suggest promise for combating some of the issues we’ve seen with EM currencies.

[1] https://home.treasury.gov/system/files/206/Appendix1FinalOctober152009.pdf

[2] https://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4

[3] https://www.swissinfo.ch/eng/business/10-years-after-the-collapse-of-lehman-brothers_the-financial-crisis-of-2008-and-the-swiss–miracle-/44397608

[4] https://www.dailyfx.com/news/em-snapshot-lira-sinks-to-new-low-but-mxn-and-brl-outperform-usd-20220927.html

[5] https://www.wsj.com/articles/saudi-arabia-considers-accepting-yuan-instead-of-dollars-for-chinese-oil-sales-11647351541

[6] https://timesofindia.indiatimes.com/business/india-business/india-is-considering-rupee-payments-for-trade-with-russia-report/articleshow/90206402.cms

Good post.